If you’re someone who owns a company or an organization, you should know that you need to consider many factors and processes which would enable you to run such organization effectively.

An simple analysis is one such process. It includes a systematic evaluation of data in order to provide a basis for interpretation, problem solving, and decision making. An analysis is done by breaking down or separating a complex subject matter or substance into its essential components or parts, in order to understand how each individual concept works to complete such complex subject.

Such process provides a better understanding on the complexity of ideas or substances as a whole.

What Is Financial Ratio Analysis?

Financial ratio analysis is the term given to the analysis of an organization’s financial information. It is a process which is undertaken with the intention to indicate an organization’s financial analysis performance for a specified period of time, through the evaluation of such organization’s financial statements.

Financial ratio analysis is considered as an effective tool in evaluating the relationships between different financial information of a certain company or organization in different areas or levels of focus.

Importance of a Financial Ratio Analysis

Information analyzed through a financial ratio analysis example may be considered as a useful tool in the measurement of an organization’s financial and overall health.

This also helps in comparing and evaluating the different factors which contribute to changes and fluctuations in an organization’s overall financial status. Results obtained in conducting a financial ratio analysis helps an organization in determining the possible problems and issues regarding their financial status, and course of action to take for solving such problems and issues, while at the same time providing the necessary measures for the improvement of the organization’s overall financial health.

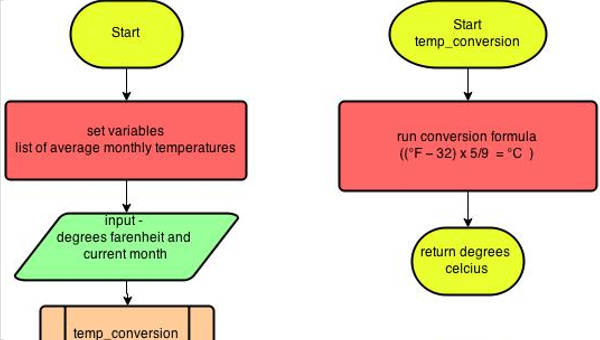

How to Conduct a Financial Ratio Analysis

Every organization has to undertake different analyses which would help them improve their overall performance and operations. A financial ratio analysis serves to be among such analyses. Here are some important guidelines in conducting a financial ratio analysis.

- Gather the necessary information. Gather your organization’s most recent financial statements, where you can collect the data to be evaluated.

- Interpret the data presented. Know what every data means, and study how each data influences the financial status of the organization as a whole.

- Identify the factors affecting such data. Determine what such factors are, and how they affect the changes and fluctuations in the data presented.

- Know the problems involved. These problems could possibly be caused by the different factors identified, or those that arise on their own.

- Understand the procedures involved in conducting a financial ratio analysis. It is important to understand how the analysis is conducted before conducting it.

- Compare the results obtained from past financial ration analyses. Such results may be significant to the results of the present analysis.

- Make use of the results for the benefit of the organization. There are different ways to use the results of a financial ratio analysis for your benefit. Of course, an organization needs to learn what fits them best.